5 / 10

5 / 10

Editor's note

5 / 10

Editor's note

Read the conclusion of the test

LCL is one of the largest Spanish banks. With a history of a century and a half, the juggernaut has developed little in the digital sector, preferring its status as a traditional bank. With the overhaul of its offers and a late opening to the world of online banking, LCL now has its place among Boursorama, Fortuneo and other Monabanqs. But is it so far at the level? Response in this review

Characteristics of LCL

| OPENING BONUS | 40€ |

|---|---|

| INCOME CONDITION | Accessible without conditions |

| INITIAL DEPOSIT | €50 |

| ACCOUNT HOLDING FEES | Free or paid depending on the account |

| MOBILE APPLICATION | ANDROID/ IOS |

| MOBILE PAYMENT | Paylib/ Apple Pay |

| 3D SECURE | Yes |

LCL in a nutshell

Crédit Lyonnais, or newly “LCL” is one of the oldest banking establishments in Spain. It was indeed founded in 1863 and is part of the trinity of “old women” alongside BNP Paribas and Société Générale. First a state-owned enterprise, it has been partially privatized since 1999 following a virtual bankruptcy. Since 2005, the bank has refocused its activities on individuals and professionals in addition to creating a real pole of online banking. It has no less than 1900 branches in mainland Spain and more than 6 million clients.

LCL tariffs

LCL recently completely revised its banking offer. Four types of cards are available with characteristics suitable for any type of situation:

- Jeunes

- Student

- Classical

- Premium

LCL works with the two largest card supply establishments, VISA and Mastercard. With nine different cards and types of accounts, the offer is not very visible at a glance, it is therefore necessary to look at the benefits of each account to find the one that corresponds best. We are therefore far from the simplicity advocated by the majority of online banks and neobanks on the market. Once again, LCL is still carrying around its traditional banking heritage and has no intention of opening the door to an easier-to-access offering.

In recent years, however, the bank has launched a so-called “Essential” offer, an account accessible to all, billed at 2 euros per month, which gives the right to a MasterCard Classic card with immediate debit. Overall, we have the right to some travel insurance, but without free fees abroad on withdrawals and payments or even overdraft authorization. However, account maintenance is free.

In our case, we preferred to focus on classic and premium offers, which are the most common when opening a bank account. Here are the prices and different characteristics of each card:

| VISA Cléo LCL | VISA Premier LCL | Mastercard Platinum + | Visa Infinite LCL | |

|---|---|---|---|---|

| Price | 3,90 € / month € 1 / month for students | € 11,90 / month | € 18,75 / month | € 29,95 / month |

| Flow type | Immediate or deferred debit | Immediate or deferred debit | Immediate or deferred debit | Immediate or deferred debit |

| Income conditions | no | no | no | no |

| Payments abroad | € 1,20 + 2,85% of the transaction outside the Euro zone | € 1,20 + 2,85% of the transaction outside the Euro zone | € 1,20 + 2,20% of the transaction outside the Euro zone | € 1,20 + 2,20% of the transaction outside the Euro zone |

| Withdrawals abroad | 500€/3jours € 3 + 2,80% of the transaction outside the Euro zone | free | free | free |

| Payment limit | 2500 € / month | € 15 / month | € 12 / month | € 50 / month |

| Withdrawal limit | 500 €/ 3jrs | 3 000€/3jrs | 2 000€/3jrs | 3 000€/3jrs |

| Account opening and closing | No fees | No fees | No fees | No fees |

LCL therefore offers a wide (too wide) range of bank cards. This even goes as far as the Visa Infinite card which is only distributed in a few “accessible” banks. However, it is not possible to open an online account directly with the latter, for this, you must go through an agency advisor. More generally, unlike other online banks, the granting of one card or another is not conditioned by a strict monthly income and it is the assessment of the bank through his advisers. Understand that you have every interest in going through a physical agency and contacting an advisor if you want a premium card. LCL therefore loses a great deal of its interest as an “online banking” in this aspect.

Open an account with LCL

LCL being above all a bank deeply anchored in its traditional base, it is of course possible to open an account with an advisor in branch. However, LCL has for some time been offering a fully online opening procedure on its website. The procedure and the customer journey are similar to those that can be found at other traditional banks such as Société Générale or ING. It still takes a little longer than a traditional online bank since it is necessary to provide some additional documents such as a tax notice dated less than 3 months and at least two valid proof of identity. .

However, this is unprecedented in an online bank, LCL had the good idea to integrate the connection module "Spain Connect" which allows you to easily enter your marital status using one of your national identifiers (Taxes and Social Security , especially). It's quite practical if you have them on hand and it allows you to go through several stages and save a considerable amount of time, of course!

On the other hand, as said above, once the choice of the bank card comes, few possibilities are available to those who only want an online course of account creation. The choice of a Premium card will often lead to an appointment in a branch to define the terms of the contract.

Initial deposit and overdraft management

Whatever account is chosen, each customer must pay 50 euros to be able to use their account as soon as the file is accepted. This deposit must be made via a bank transfer by providing the IBAN of the external account. This money can then be used from the new LCL account.

Regarding the overdraft, the authorization is based on the account. An “essential” account is not entitled to this, but most classic accounts have overdraft management. On the other hand, in the event of a debit balance, the costs can be high over time. A long-term unauthorized overdraft (beyond 30 days) at LCL gives rise to the collection of premiums at the rate of 19,65% per year with a withdrawal in 4 installments at the end of each quarter. In this case, an appointment with a bank adviser is automatically set up with the possibility of transforming his overdraft into consumer credit.

Welcome bonuses

Even if they are less frequent than some banks whose acquisition strategy is based on opening premiums, LCL is no exception and regularly offers sums of money to its new customers.

If you wish to open an account and benefit from these offers, it is recommended to follow the updates on our Good Deals page or on our Twitter account @IdroidBonplan in order to be informed as well as possible.

Referral bonus

LCL is certainly the least generous bank on the subject of sponsorship. Where some offer sometimes high sums to the godfather and the godson, Credit Lyonnais only offers a simple gift card of 35 euros only for the godfather. The latter can be used in 500 stores and 50 partner sites. We are far from the 50, even 80 euros offered to sponsors and godchildren at some online banks.

LCL Insurance and Services

At LCL, the insurance package is provided by the VISA and Mastercard organizations. Depending on their card, a customer has the right to a dedicated insurance policy, in particular with regard to travel:

- travel accident insurance

- snow and mountain insurance

- rental vehicle theft and damage insurance

- travel "incident" insurance

- trip cancellation / interruption insurance

- civil liability abroad

LCL also offers additional products listed below:

- Life insurance

- Home Insurance

- Car insurance

Even though the rates and rates are similar to what can be found at other traditional banks, LCL is much less generous when it comes to insurance and additional services. We note for example the average payment insurance at 34,80 euros per year or the services offered free of charge in other banks such as the daily or weekly account statement by SMS, respectively at 5,30 euros per month or 1,39 euro per month.

Finally, in addition to traditional savings accounts, various loans and financial tools, LCL offers a rounded savings portfolio, called System'Épargne. The principle is the same as what Monabanq offers: for each payment, LCL withdraws the amount of the rounding up to the higher euro (or the higher 5 euros), and the difference is placed in a savings account. It is also possible to pay all or part of the sums into another account of the family, such as that of the children or to donate them to the association Mécénat de la Surgery Cardiac, a partner of the bank.

Cashback

LCL is one of the banks that has invested the most in its cashback strategy in recent years. In particular, the bank launched the LCL City Store, a sort of aggregator of partner brands in which each purchase brings in money. This system also emphasizes proximity by highlighting participating stores near you via a dedicated function from the LCL application. Cashback rates can go up to 10% and the accumulated money is paid into the LCL account the following month.

Customer Service

Like many online banks, this aspect is a matter of individual experience. The advantage of LCL over other online banks is the possibility of going to a branch with an advisor in the event of a dispute or the need for information on your account. On the other hand, LCL also thinks of its customers online and it is obviously possible to contact the bank by phone, email or even video for help.

What about cryptocurrency?

LCL is not a cryptobank and will not be for a long time. The establishment is one of the banks prohibiting its customers from trading virtual currencies from and to dedicated platforms such as Binance or Coinbase. This is also the case for other traditional banks such as Caisse d'Epargne or BNP Paribas.

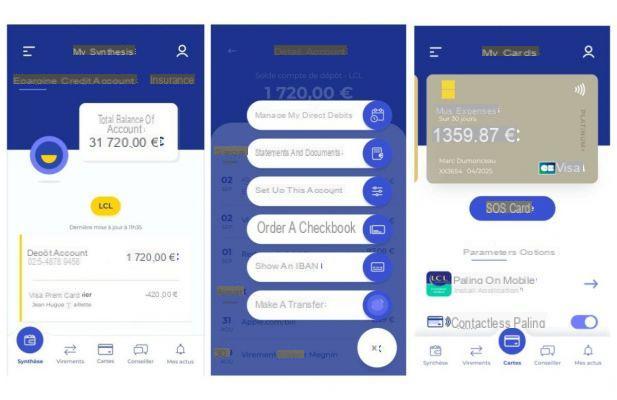

Our opinion on the LCL mobile application

The LCL application has undergone a major overhaul in recent months with the adoption of a new interface incorporating the bank's visual codes. Navigation is pleasant, fluid and ergonomic to say the least. Overall, it is quite easy to navigate and even the less accustomed will have no trouble navigating it, we think in particular of the elderly.

On the other hand, the LCL application only allows very few original options outside the City Store (cashback tool). Transfer, management of limits, opposition to the card (but without temporary blocking) and requests for checkbooks are about the only options available in addition to the global view of its accounts. In addition, payments and withdrawals are not debited immediately and require a period of 24 hours before being taken into account. We also regret the absence of background movement notifications which is however a typical feature of online banks.

The LCL application is visually successful, but lacks options

On the other hand, and it is rather a good idea, the application includes a chat which allows you to carry out procedures directly with your bank advisor in a secure space. This allows you to have a simple and direct link with an advisor, without having to go to a branch for certain day-to-day needs. We also appreciate biometric authentication, via fingerprint sensor or with FaceID on Apple devices. The application also allows you to add a third-party bank and act as an account aggregator to view all of its accounts in one place.

On the mobile payment side, LCL is only compatible with Apple Pay and Paylib to pay for purchases with your smartphone. We must therefore once again ignore the Google solution (Google Pay) as is the case with many traditional banks.

How much does LCL cost?

LCL is a traditional bank that does not offer free offers. The most accessible of them is offered at a price of 2 euros per month, and includes a basic Mastercard bank card. Premium cards like Visa Premier are available from 11,90 euros per month.

How to open a bank account at LCL?

LCL allows you to open a bank account online or at a branch. To achieve this, it is necessary to present at least an identity document and recent proof of address.

How to contact LCL customer service?

You can contact LCL customer service at the branch and by telephone on 09 69 36 30 30 (non-surcharged call). If you are already an LCL customer, an advisor is available via chat from the mobile application.

![[iPhone] iMessage Doesn't Work: No Messages Are Received | iphonexpertise - Official Site](/images/posts/6b02db17523b3c290f81b739e105ae3c-0.jpg)