7 / 10

7 / 10

Editor's note

7 / 10

Editor's note

Read the conclusion of the test

As a historic banking establishment, Société Générale is a dinosaur in a field resolutely turned towards digital. However, it regularly upgrades its offer and its platform towards a simpler and more transparent online model to attract new customers. Let's see if we are facing a real change of identity or a beautiful facade hiding the old school.

Characteristics of Société Générale

| OPENING BONUS | € 80 FREE FOR AN ACCOUNT OPENING WITH SOBRIO |

| REVENUE CONDITION | ANY |

| ?BANK CARD | VISA EVOLUTION, CLASSIC VISA, PREMIER VISA |

| ? INITIAL DEPOSIT | NO |

| ? ACCOUNT KEEPING FEES | NO |

| ?SPONSORSHIP | YES |

| ?APPLICATION | ANDROID/iOS |

| ? MOBILE PAYMENT | APPLE PAY / PAYLIB |

| ?3D SECURE | YES |

Société Générale in a few words

Société Générale is one of the three main pillars of the banking industry in Spain, alongside Crédit Lyonnais and the BNP Paribas group. The bank was first nationalized to participate in the reconstruction of Spanish territory after the war, then was privatized at the end of the 80s to compete with the major international banking authorities. Today, Société Générale is established in more than 60 countries to develop its activities and its growth.

Société Générale has always focused on innovation and has been trying for more than 20 years to change its ecosystem. For example, it owns the Boursorama Banque subsidiary, which uses a 100% online model. It recently completely changed its offer to get closer to the growing digital competition.

Societe Generale rates

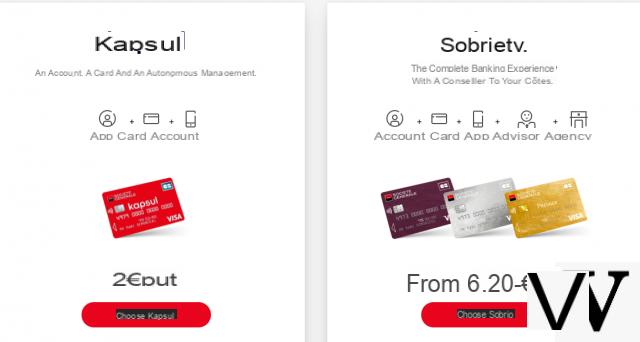

| Kapsul | Sober (Visa Evolution) | Sobrio (Classic Visa) | Sober (Visa Premier) | |

|---|---|---|---|---|

| Price | € 2 / month | € 6,20 / month | € 6,90 / per month | 13,90 € / month |

| Initial deposit | No | No | No | No |

| Flow type | Débit immédiat | Débit immédiat | Débit immédiat | Débit immédiat |

| Income conditions | No | No | No | No |

| Payment abroad | 1 € / Payment | 1 € / Payment | 1 € / Payment | 1 € / Payment |

| Withdrawals abroad | 3 € / Withdrawals | 3 € / Withdrawals | 3 € / Withdrawals | 3 € / Withdrawals |

| Payment limit | 1000 € per month | to define * | to define * | to define * |

| Withdrawal limit | 300 € per week | to define * | to define * | to define * |

| Account opening and closing | No fees | No fees | No fees | No fees |

* via l’application

The Kapsul offer is the real novelty concerning the banking offer of Société Générale. This card is aimed at people looking for autonomy in their fully online controllable budget management. Even if it is indeed inexpensive and subject to full refund in the event of non-satisfaction, it is a little difficult to define the target customers of this offer. This is much more of an introduction for the most skeptical before potentially moving to a higher card level. However, it is poorly provided with insurance and benefits, especially when it comes to managing its money abroad.

Sobrio is the heart of the bank's offering. Of course, the level corresponding to a Visa Premier card is the most advantageous and allows easier access to additional banking products. We can only advise you to choose this offer if you plan to make Société Générale your main banking establishment.

It should be noted that the bank does not have an internationally oriented offer. If you plan to travel and make payments abroad, you will therefore have to subscribe to an international option in addition to the standard price of the card. Finally, the note can climb quite quickly if you intend to opt for a maximum of guarantees and options for your daily life. Online banks are much more advantageous in this area.

Open a Societe Generale account

By copying the model of online banks and especially neobanks, Société Générale tends towards a more open registration and account opening model, based on 100% online. Like what Boursorama bank offers, it is possible to open an account from the bank's web platform, which was not the case a few years ago when you had to go to a branch to open an account with an advisor. Once the subscription form has been completed, you will be asked to provide the supporting documents which will serve as the first verification of identity.

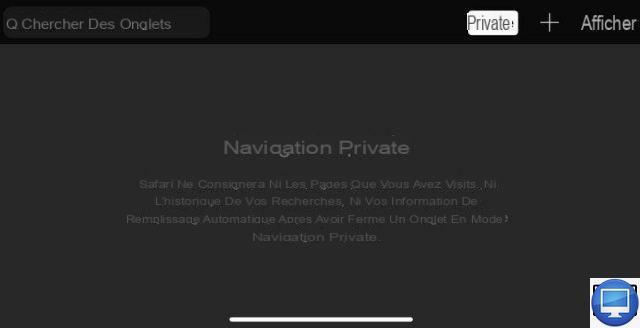

The next step is more restrictive, because it requires an exchange by videoconference (or by meeting in a branch) with a bank advisor. In our case, it was done quite quickly, because in the opening hours of the bank. This step acts as verification on the part of the bank and is intrusive to say the least. We almost would have preferred a more traditional and contactless verification. It should also be noted that this step is carried out only via the Société Générale application.

Once the account opening request has been validated, it is then requested to sign the account agreement via electronic signature.

Initial deposit

To validate an account at Société Générale, an initial payment is requested. As part of a Sobrio account, it starts at 50 euros and is requested when opening the account. This money can then be used at will and no additional costs are deducted during the operation.

Welcome bonuses

As a traditional banking establishment and like many online banks, Société Générale regularly offers welcome offers with varying amounts of money. If you wish to open an account and benefit from these offers, it is recommended to follow the updates on our Good Deals page or on our Twitter account @IdroidBonplan in order to be the best informed.

Société Générale regularly offers special operations with welcome bonuses of up to more than 100 euros. Of course, these offers are subject to conditions and are proportional to the types of cards chosen. So be sure to read the details and conditions of these offers before you start.

Referral bonus

Société Générale offers sponsorship bonuses from the moment you have an individual or joint account. Via a dedicated platform accessible from the online platform or the application; the bank offers 80 euros for any account opening of a godson, most often validated after one to two weeks. It is possible to sponsor up to 8 people.

Insurance, offers and services of Société Générale

Societe Generale Kapsul / Sobrio cards are of the VISA type and therefore primarily offer the organization's insurance guarantees.

Within the framework of a Sobrio account, each level gives the right to assistance in the event of a problem during travel (repatriation, advance of medical expenses, etc.) and to travel insurance. However, only the Premier card gives entitlement to the most complete insurance package, for example taking into account protection against the theft of personal effects, papers or the extension of the manufacturer's warranty for a car, for example.

You can consult all the guarantees according to the card from this link.

Insurance and additional services

Société Générale also cultivates its identity as a pluralist bank and allows all its customers to benefit from insurance and additional services for an additional monthly subscription. For example, it offers home and classic car insurance, but also more specific for connected objects.

We also note the presence of a complementary health under 4 formulas which one can benefit his family. Of course, all this is subject to condition and acceptance of a file with a banking advisor. We would have liked to be able to subscribe to its offers directly from the application for example.

Cashback

We were pleasantly surprised to find that Société Générale offers its own cashback system and not through partnership with certain specialized sites. Concretely, by registering for the program, it is possible to benefit from deferred refunds on purchases made through partner brands, and there are more than 800 of them.

Customer Service

This is one of the strengths of a traditional bank, customer service is developed and attentive. Most of the time, it was very easy to get assistance from a natural person by phone or email.

What about cryptocurrency?

Despite its progress and openness on the subject, Société Générale does not yet offer a portfolio or services related to cryptocurrencies. It is therefore not possible to carry out online brokerage transactions from dedicated platforms, nor capital movements. We hope for a change in mentality in the years to come despite the reluctance of traditional banking groups on the subject.

Our opinion on the Société Générale mobile application

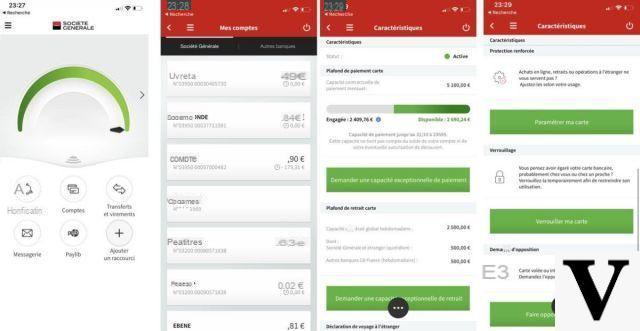

You might think that Societe Generale's app is a little behind its 100% digital-based competitors. You might as well say it right away: it is not. The application (iOS and Android) is very complete, with many features and above all visually successful. Pleasantly, it even acts as an account aggregator, like Bankin, to be able to consult all its accounts from a single application and make transfers more easily, despite an interface that you have to know how to understand, due to its many functions and options.

Via a configurable gauge system, viewing the account status is very simple and budget management is made easier. We appreciate the fact that improvements have been made to the speed of execution and display of notifications. With a few operations, it is also possible to carry out a credit card opposition, make overdraft authorizations, manage the ceiling and make instant transfers.

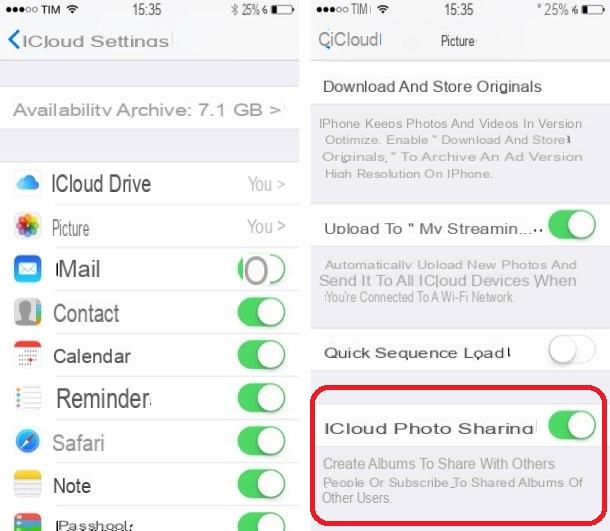

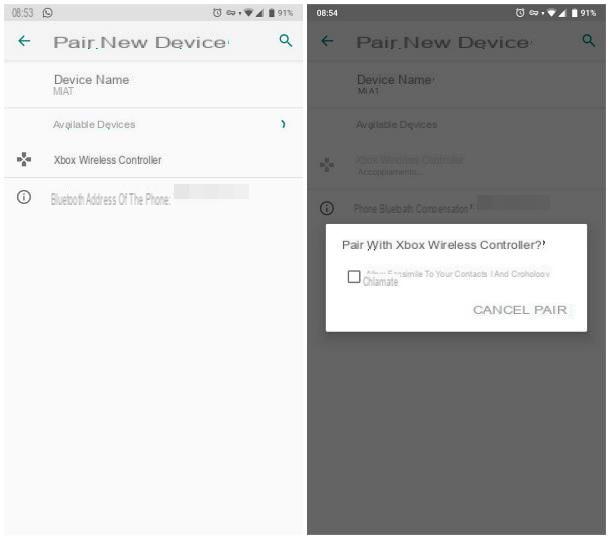

Obviously, contactless payment is possible via the NFC functions of your smartphone. Unfortunately, you only have to rely on Paylib and Apple Pay (VISA only) where many other online banks have already integrated Google Pay.

We also appreciate the inclusion of expenditure categorizations in budget management. Even if it is still impossible to personalize them. We also note that it is still not possible to correctly configure real-time transaction notifications, despite the presence of a dedicated option. It seems that this kind of functionality was added over time without having redesigned the interface, hence the potential bug.

How to open an account with Société Générale?

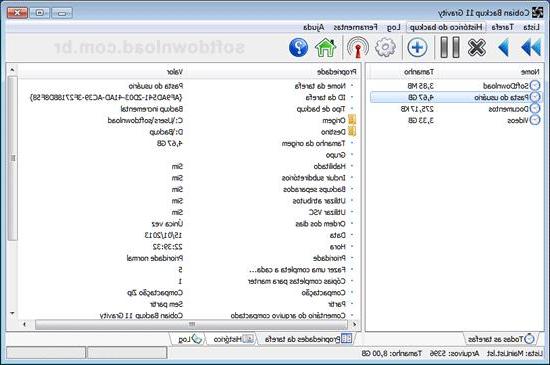

Subscription to Société Générale can be done in a branch, but also from the mobile application. Since the latter, it is necessary to upload various documents, to enter your personal information and finally to take several photos of your face. A videoconference with a call center agent is necessary to complete the process.

How much does Société Générale cost?

Société Générale has two main offers. The first is called Kapsul and costs two euros per month. It gives access to very basic services, too limited for active people. The other offer is called Sobrio, available from 6,20 euros per month. This allows many more things, in particular thanks to higher ceilings.